The information contained in this article was correct at the time of writing

November 19, 2023

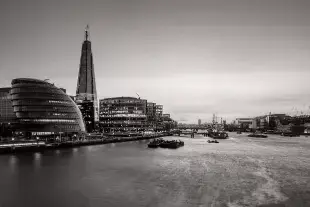

UK Property and Real Estate – An Overview

The UK property market is one of the most highly sought-after real estate investment destinations globally. As an island nation with limited land supply and a growing population now exceeding 67 million, property here consistently rises in value over the long term. Prime London locations in particular have seen enormous property price growth in recent decades, rivalling top-tier global cities like New York, Hong Kong and Singapore.

The UK’s world-class education system, expanding tech and finance sectors and relative political stability also attract significant foreign investment into both commercial and residential real estate nationwide. Given English as the international language of business, the UK also offers unparalleled access and transparency for overseas investors.

Residential Property Market Overview

The UK’s residential property market has delivered steady, resilient returns historically, despite periodic downturns. Today’s market faces fresh challenges, including stressed affordability – the average UK house price now exceeds £250,000, over 8 times the average salary. First-time buyers in particular struggle accessing the market without family assistance.

The government has intervened with schemes like Help to Buy, which enabled 600,000+ buyers to purchase with a 5% deposit. Additional government housing subsidies like Shared Ownership allow buyers to initially purchase just 25%-75% of a home. Ongoing strong demand also continues to drive rents higher across most major UK cities.

Property values have softened slightly since 2016, impacted by both Brexit uncertainty and affordability ceilings. However prices are again on an upward trajectory in 2023 as buyer confidence improves. Prime central London especially saw a strong bounce back in 2022, with fierce competition for the most coveted neighbourhoods.

The Outlook for Buy-to-Let

Beyond home owners, the UK’s strong tenant demand makes buy-to-let investment highly attractive still. Ongoing urbanization and population growth coupled with high property prices drives more young professionals into long-term renting. Outside London, major university cities like Manchester, Birmingham and Leeds have thriving rental markets.

Buy-to-let yields average 4%-8% nationwide currently. Leveraging still-low interest rates, many small-scale investors have built property portfolios across Britain’s strong rental regions. Purpose-built student accommodation also produces consistently higher yields given surging university attendance.

However, buy-to-let taxation has increased, with landlords now paying an additional 3% stamp duty. Other policy and regulatory changes have added reporting requirements. Using a specialized property management company can help navigate recent tax changes.

The Importance of New Housing Supply

From reviewing income sources to the strategic use of tax exempt wrappers, here are some of the main planning levers individuals and businesses can utilise:

Housing undersupply remains perhaps the largest single issue facing UK residential real estate. An average of only 170,000 new homes were built annually the past decade versus government targets exceeding 300,000. This lagging supply fans price growth across much of Britain.

The government has committed to large investments in new housing development nationwide. Additional public incentives for builders along with faster planning approvals seek to accelerate supply. Experts caution however that the UK must sustain higher construction rates for years before market stabilization.

Alongside affordability, helping future generations access the market remains a policy priority. In the interim demand continues rising from newly formed households. Britain’s population is projected to pass 70 million by 2030, implying no near-term easing of housing shortages.

Commercial Property Market

Shifting to commercial real estate, the UK likewise offers size, transparency and stability that attracts significant domestic and overseas investment. Global investors often establish London or wider Britain as their European headquarters given its business-friendly environment coupled with direct access to the EU single market.

Office Space – the London Effect

London in particular remains a globally coveted location for premium office space. Prime rents in the best parts of London rival top world cities, averaging over £82 per square foot annually. Occupancy also remains very tight, driving competition between financial services firms, big tech companies and other corporates for the best spaces.

Canary Wharf has emerged over the past decade as London’s second major finance and banking hub alongside the traditional City locale. Space in new Canary Wharf developments achieves rents exceeding £55 per square foot now, catering to banking giants like Citigroup, Credit Suisse and Morgan Stanley. Major developers continue advancing plans for additional high-end projects in the area given insatiable tenant demand.

The Edinburgh Tech Phenomenon

Beyond London, other UK cities have established their own magnetism for commercial real estate occupiers. Edinburgh for example has developed into one of Europe’s fastest growing tech and creative hubs over the past 5-10 years. Big tech players like Skyscanner and FanDuel have established major offices in the city, drawn by abundant tech talent from Edinburgh’s universities and by substantially lower costs than London.

City centre office rents average just £32 per square foot – though still climbing quickly. Scotland also offers very competitive tax incentives for companies headquartering in Edinburgh or Glasgow. For investors, Scottish commercial property offers an alternative entry point to access the UK’s growth without London prices. Local professional expertise is vital however given unique regulations and practices.

Retail Property Troubles

Retailing has traditionally been a cornerstone of British commercial property. However, the seismic shift toward ecommerce this past decade has profoundly impacted UK high streets and shopping centres. Well over 11,000 chain store outlets have closed since early 2020 as more spending moves online. Retail property values have correspondingly struggled.

Top-quality shopping centres maintain decent demand from retail brands. But second-tier malls have seen high vacancy rates and plunging rents – numerous centres are expected to be repurposed or face demolition in coming years with retail unlikely to recover significantly. Distress has created some contrarian opportunities though for specialized investors capable of refreshing damaged properties.

Meanwhile neighbourhood high streets with a mix of cafes, salons and local traders have proved more resilient than large shopping centres struggling to attract customers. Investors are increasingly focused on these community-based retail locales.

Logistics and Distribution – Outsized Demand

If retail properties face existential threats from internet shopping, logistics and distribution centres are experiencing unprecedented demand. Every large retailer racing to perfect online deliveries requires extensive warehouse capacity within proximity to major transport links.

Amazon alone has amassed dozens of fulfilment centres across Britain – it now has 97 million square feet of space in the UK. Rapid changes in shopping patterns will necessitate yet more logistics facilities in prime locations during the years ahead. Given fierce competition for best-in sites, valuations have soared for modern, strategically located distribution assets. The UK’s logistics property sector will likely expand by another 15% at least within this decade.

Uniquely Attractive Alternatives

Beyond offices, malls and warehouses, UK commercial property also spans specialized segments drawing dedicated investor interest. Alternatives like student housing, care facilities, medical properties and data centres are less exposed to economic cycles – and lease terms in these institutional-grade sectors often span decades, not years.

Healthcare assets in particular are forecast to see unmatched growth in coming decades with Britain’s population aging rapidly. Care homes trading at average 7% yields with 20-30 year leases underpinning them are drawing intense demand from property investors seeking secure long-term returns.

How to Access UK Property and Real Estate

For overseas investors, credible local representation is vital when accessing UK real estate. Regulation and taxes for foreign owners have increased significantly recently. So trusted in-country relationships are essential to navigate bureaucratic compliance.

UK property also carries some unique risks, as assets transact generally freehold instead of leasehold. Plus long completion times for deals means patient working capital is required. Our team bring these required regional insights and our networks to help international investors, developers and landlords successfully build UK property exposure.

Get in Touch Today

With broad, sustained demand across both commercial and residential real estate, seasoned investors understand the enduring value offered by UK property. As with any complex market though, realising actual rewards requires working with specialists carrying localized knowledge and connections.

For further guidance accessing specific UK real estate sectors or geographic regions of interest, contact us today. Our experts combine decades of experience with on-the-ground intelligence across this diverse marketplace. We look forward to helping you capitalise on the opportunities ahead across the UK’s property and real estate markets.