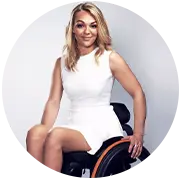

CLIENT’S FEEDBACK

Hear what Clients and Associates say about Gavin Tank London

FAQ

General Question

We’re ready and here to help, why now schedule a free consultation. Let’s create a precision in protection plan that aligns with your personal journey.

We advice level term, decreasing term, whole of life, and family income benefit policies.

Life assurance provides a tax-free lump sum or income to your loved ones if you pass away during the length of the policy. This can help cover funeral costs, mortgage payments, and provide ongoing income.

You can apply anytime to increase your life, critical illness and income protection covers as your needs change, such as getting married, having children, or increasing your mortgage under the policies “guaranteed insurability” option

Please speak to our adviser for guidance.